Introduction

Are you looking for a personal loan? Personal Loan Guide 2025 is the right place to get an idea about it. Whether looking for quick cash, funding for your small business, or financial help as a student, understanding the basics of personal loans can set you on the right path. With AI-driven technology in the financial sector, accessing funds has become quicker, simpler, and more transparent than before.

These few minutes will help you understand the types of loans available, basic eligibility requirements, range of interest rates, and how to apply for one that suits your financial needs. By the end of this article, you’ll clearly understand where to approach and how to easily get your loan.

What Is a Personal Loan?

A personal loan is an unsecured loan that allows you to borrow money without needing to provide collateral, such as a car or property. It is disbursed as a lump sum; you repay the loan in equal monthly installments over a set duration, usually ranging from 1 to 5 years.

Key Features of Personal Loans:

- Unsecured (no collateral required)

- Set a repayment period and low fixed monthly installments.

- Flexibility to use the loan amount for various purposes (e.g., education, home renovation, or emergencies)

Benefits of Personal Loans

Here’s why personal loans continue to be a popular choice for borrowers:

1. No Collateral Needed

Unlike home or auto loans, personal loans don’t require you to pledge any asset as security, making them accessible to individuals without significant assets.

2. Quick Approvals

Personal loans, especially with digital lenders or loan apps, often have swift approvals—sometimes within hours—making it easy to secure funds during emergencies.

3. Flexible Use of Funds

The loan amount can be used for any purpose—paying medical bills, funding a wedding, consolidating debt, or even starting a small business.

4. Wide Eligibility Options

Even with a low CIBIL score or inconsistent income, you can often find instant loan options tailored to your financial circumstances.

Types of Personal Loans

Personal loans are designed to meet diverse needs. Below are some common types available in 2025:

1. Personal Loans for Low CIBIL Scores

Ideal for borrowers with a lower credit score, these loans focus on an alternative assessment of eligibility (e.g., income stability) rather than just credit history.

2. Personal Loans Without Income Proof

Do you need money but don’t have traditional salary slips? Specific lenders offer instant loans based on alternative proofs, like bank statements or client invoices.

Keywords to explore through lenders include “loan app without salary slip” or “personal loan app without salary slip.”

3. Personal Loans for the Self-Employed

Designed with flexibility, these loans cater exclusively to entrepreneurs and freelancers needing quick cash flow without rigid income structures.

4. Small Personal Loans (e.g., ₹20,000 to ₹1 Lakh Loans)

Perfect for managing short-term expenses, these loans are fast and straightforward, often available through “small amount loan apps” or “quick cash loan apps.”

Eligibility and Documentation

Before applying, it’s important to know the general eligibility criteria and documents required to boost your chances of approval.

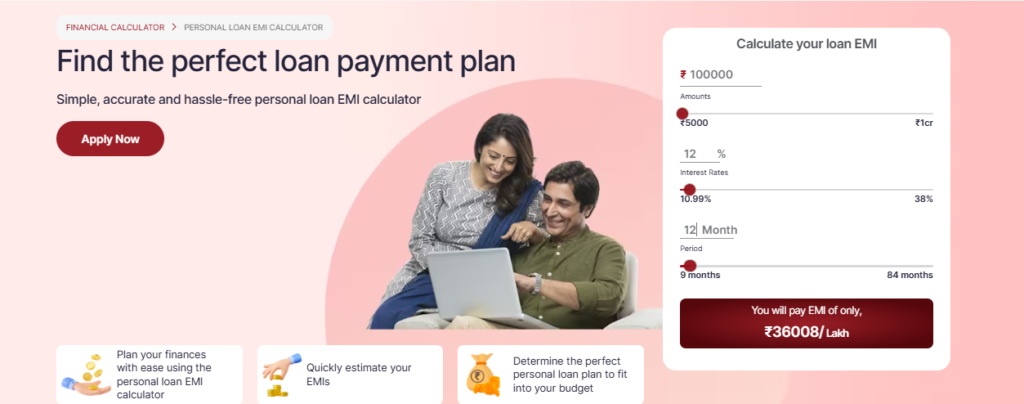

For example, borrowing Rs.1,00,000 at an interest rate of 12% over one year would mean your EMIs include both principal and interest and show an EMI of Rs.8,885.

Click Here : IDFC BANK Personal Loan Calculator

General Eligibility Criteria:

- Age: 21-60 years

- Income: Minimum stated income (varies by lender)

- Credit Score: A CIBIL score of 650+ is preferred but not mandatory for specific lenders

- Employment: Proof of employment or self-employment

Required Documents:

- Identity Proof: Aadhaar Card, PAN Card, or Passport

- Address Proof: Utility bill, rental agreement, or Aadhaar Card

- Income Proof: Salary slips, bank statements, or income tax returns

- Employment Proof: Offer letter, employer certificate, or business invoices

How to Apply for a Personal Loan

Follow these steps to apply for a personal loan seamlessly and avoid any hurdles:

Step 1. Determine Your Loan Requirements

Define the amount you need, the suitable repayment plan, and the best loan type for your specific circumstances.

Step 2. Compare Interest Rates

Research various lenders, loan apps, or online platforms. Check interest rates, processing fees, and terms offered. Low-interest options such as “instant loans” or “small loan apps” can save significant costs.

Step 3. Check for Hidden Costs

Review documentation carefully to identify hidden charges, such as prepayment fees or penalties for late payments.

Step 4. Use a DSA or Agent (Optional)

A Direct Sales Agent (DSA) can help streamline your loan application process and guide lender options.

Step 5. Submit Your Application

Provide your documents online or at a branch, depending on the lender’s preference.

Step 6. Review Loan Offers

Once approved, compare loan offers and their terms before signing the agreement. Look for flexibility and transparency.

Understanding Personal Loan RBI Guidelines

Be aware of the Reserve Bank of India (RBI) guidelines, which introduce essential protections for borrowers’ rights in personal loans.

- 15-Day Credit Reporting Rule:

- Lenders must update credit reports every 15 days to provide a more accurate and current reflection of financial activity.

- Increased Risk Weights on Personal Loans:

- The RBI increased personal loan risk weights by 25%, potentially raising interest rates for borrowers.

- Loan Application Transparency:

- Lenders must provide clear, detailed loan applications outlining rates, fees, and charges.

- Clear Rejection Communication:

- If a loan is rejected, lenders must explain the applicant’s reasons for rejection.

- Handling Defaults with Compassion:

- Lenders are encouraged to work with borrowers facing financial hardship to create suitable repayment plans.

- Legal Action for Non-Payment:

- Lenders can take legal action under Section 138 of the Negotiable Instruments Act for consistent non-payment.

Tips for Managing Personal Loans

A personal loan is a long-term commitment. These tips can help you manage it effectively:

- Pay on Time: Avoid penalties and improve your credit score by making timely payments.

- Use Wisely: Ensure the loan funds are used efficiently to address genuine needs. Avoid splurging on non-essential expenses.

- Refinance When Needed: Refinancing can save you money in interest if you find a lender offering better terms.

Is a Personal Loan Right for You?

Before applying for a personal loan, ask yourself:

- Do I need the funds?

- Does my financial situation support timely repayments?

- Have I explored alternative funding options, such as savings or family loans?

Making a decision that aligns with your financial goals and ability to repay will leave you better off in the long run.

Personal Loan FAQ’s

What is the interest rate of an IDFC personal loan?

The interest rate on IDFC personal loans typically ranges from 10% to 15% per annum, depending on the applicant's credit profile.

What interest rates will the banks predict in 2025?

Banks may reduce interest rates in 2025, with predictions for a 25-50 basis point cut in the repo rate to boost economic growth.

Conclusion

Personal loans today are more accessible and flexible, thanks to technology and more explicit RBI guidelines that protect borrowers. With a better understanding of the types of loans available, eligibility requirements, and the simple application process, you’re better equipped to choose the right loan for your needs. Avoid high-interest loans and fake loan apps; always check the details before applying. If you need guidance, drop comments or email us.

Happy borrowing—stay connected!

Most-Read Topics You Can’t-Miss!

RBI’s New Loan Rules 2025 | How Banks Evaluate Your Loan Application | Understanding Bank Loans, NBFC Loans, and Fintech Loans