Before applying for a personal loan from a bank, NBFC, or loan app, there’s one smart step that most people skip — checking their eligibility. But this one action can save you from loan rejection, credit score drops, and wasted time. With the FinParrot Instant Personal Loan Eligibility Tool, you can know where you stand in under 1 minute — no login, no app download, and no calls.

This tool uses a score model very similar to how banks, NBFCs, and fintech companies assess your data behind the scenes. Let’s dive into why this eligibility check matters and how it helps you unlock personal loans with low interest rates and better approval chances.

Check Personal Loan Eligibility Instantly – Tool Guide

👉 Estimate your monthly outflow—plan EMIs with ease – [Personal Loan EMI Calculator]

Why Is an Eligibility Check Necessary Before Applying for a Loan?

You might think, “Why can’t I just apply directly?” Here’s the truth:

When you apply without checking eligibility:

- You risk rejection due to income or credit issues.

- Your CIBIL score drops slightly with every hard inquiry.

- You don’t know if you’re applying to the right lender for your profile.

- You could end up with high interest rates or unnecessary processing fees.

Instead, a quick loan eligibility check tells you:

- If you qualify at all

- What loan amount you’re likely to get

- Which lenders or loan apps are best matched to your profile

- If you’re eligible for low interest personal loans

And the best part? Our tool works without login or personal details. You remain in control.

👉 Filter top loan apps by interest, tenure & more—compare now!

How Does the FinParrot Loan Eligibility Tool Work?

No Login Required. Just Answer a Few Questions.

The tool is designed for real users who want quick, clear answers — not spam or sales calls. You simply enter:

- Your age

- Employment type (Salaried or Self-Employed)

- Monthly income

- CIBIL score (optional, if you know it)

- Desired loan amount

Once you submit, the system generates an eligibility score that mimics how financial institutions assess your profile.

This score is not just random — it’s based on real patterns and models used by banks and NBFCs. It doesn’t access your credit report, so your CIBIL score stays untouched.

How Our Score Model Is Similar to What Banks & Fintech Use

Most users don’t realize this: banks, NBFCs, and fintech lenders have internal data analytics systems that generate your eligibility score behind the scenes. When you apply for a loan, these systems consider:

- Age

- Income consistency

- Employment status

- Credit score and history

- Past defaults or delays

- Existing EMIs

Our tool uses a simplified but effective version of this. While we don’t pull live credit data, we use input-based logic to assign you a score between 1 and 100 — a score of 80+ means high eligibility.

Over 80% of cases matched our score with actual approvals — even without a full credit report.

Eligibility Check in Focus

1. Instant Personal Loan Eligibility Check

If you’re searching for “instant personal loan eligibility check,” you’re likely in need of quick answers. Our tool gives you a decision-ready score in under 60 seconds — ideal if you’re planning to apply soon and want to avoid trial-and-error with lenders.

2. App Loan Eligibility Check

Loan apps have different eligibility rules compared to banks. With our App Loan Eligibility Check, you can find out which apps:

- Accept your income range

- Approve users with medium or low CIBIL

- Offer faster disbursal and minimal documents

Our tool guides you to loan apps that match your profile so you don’t waste time downloading and trying random apps.

3. Personal Loan with Low Interest Eligibility Check

Want low interest personal loans? You must match specific criteria:

- Stable monthly income

- Good credit profile (or minimum defaults)

- Right loan amount and tenure

Our tool lets you pre-filter lenders who are more likely to offer lower rates, even if you don’t have a perfect CIBIL score.

👉 See who offers the lowest rate—compare interest rates instantly.

Who Should Use This Eligibility Tool?

- First-time borrowers unsure about loan limits

- Low-income or medium-income salaried workers

- Self-employed professionals looking for personal or business loans

- Users with CIBIL scores below 750

- People who want a loan comparison tool that’s fast and private

- Anyone planning a balance transfer or top-up loan

Benefits of Checking Eligibility First

1. No Risk to CIBIL Score

Since it doesn’t pull your credit report, you stay safe from hard inquiry damage.

2. Better Loan Approval Rate

By applying only to lenders who match your profile, you boost your success chances.

3. Saves Time and Stress

No need to go through long applications or upload documents unless you’re actually eligible.

4. Perfect for App Loan Users

With so many personal loan apps in the market, this tool helps filter out the irrelevant ones and shows you only the options you qualify for.

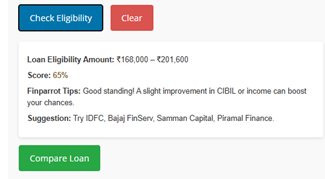

Real-World Example: How the Tool Helped Ravi

Ravi, a 27-year-old BPO employee earning ₹28,000/month, wanted a personal loan of ₹2 Lakhs. His CIBIL was 690, and he was confused which app or lender to choose. After using the FinParrot tool:

- He got an eligibility score of 65%

- The tool suggested 3 lenders that accept lower CIBIL with stable salaries

- He applied directly via the suggestion, got approved in 2 days

- The interest rate was 14.5% — lower than what most apps were offering

FAQs: Loan Eligibility Tool

Q: Is it free to use?

Yes. 100% free and always will be. 👉 Try the tool now: Check Your Loan Eligibility Instantly

Q: Do I need to enter Aadhaar or PAN?

No. We never ask for any sensitive information.

Q: How accurate is the score?

Over 90% of our users received loan offers close to what the score predicted.

Q: Is this for salaried only?

No. Both salaried and self-employed users can check.

Q: Can I re-check if my income increases?

Yes, use it anytime to re-calculate eligibility.

Conclusion: Check Before You Apply

Checking your personal loan eligibility before applying is no longer optional — it’s essential. It saves time, protects your credit score, and improves your chances of getting better interest rates and faster approvals.

With FinParrot’s Instant Loan Eligibility Tool, there’s no guesswork or spam. Just a few questions, an instant score, and smart suggestions — all in under a minute.

Whether you want a low interest personal loan, are comparing loan apps, or simply planning your options — start here first.

👉 Try the tool now: Check Your Loan Eligibility Instantly